When an OEM program moves from prototype to production, deep drawn metal stamping often looks deceptively simple: a punch, a die, a press, and a part that “just forms.” In reality, deep drawing is a controlled balance of material flow, friction, strain, and tooling performance, and every one of those variables can quietly move your piece price up—or help you drive it down.

This guide breaks down the real cost drivers in deep drawn metal stamping so sourcing teams, design engineers, and program managers can make earlier, smarter decisions. It’s written for practical OEM work: DFM tradeoffs, tooling strategy, quality documentation, and the “hidden” costs that appear only after launch.

Table of Contents

Understanding deep drawn metal stamping cost structure

Deep drawn metal stamping is a sheet-metal forming process where a flat blank is drawn radially into a die cavity by a punch, often using a blank holder to control metal flow and prevent wrinkling. Wikipedia In many designs, the part may be redrawn through multiple dies to reach depth, control wall thickness, or improve dimensional stability. Wikipedia

Cost is not only “press time + material.” For OEM programs, cost is an ecosystem that spans design decisions, die life, scrap rate, inspection plan, secondary operations, packaging, and the quality evidence required for launch and change control.

The two buckets that dominate total cost

The total cost of deep drawn metal stamping usually concentrates into two big buckets. The first is non-recurring engineering (NRE): die design/build, tryout, gauges/fixtures, and early validation work. The second is recurring piece price: material, press time, labor, consumables, yield, and ongoing quality control.

If you treat cost only as “piece price,” you risk paying later via engineering changes, extra die stations, rework, or unstable production output. In high-volume OEM work, the cheapest quote is often the one that assumes the most risk.

Why OEM programs amplify cost drivers

OEM programs magnify cost drivers because they come with strict timing, change control, and quality evidence expectations. Many automotive supply chains, for example, operate under IATF 16949 requirements, which emphasize defect prevention, variation reduction, and documented process control. IATF Global Oversight Even outside automotive, OEMs frequently require structured submissions (samples + documentation) before approval and ramp.

Part design choices that change stamping cost fast

The biggest cost lever is not a faster press. It’s the geometry you commit to before tooling is cut.

Depth-to-diameter ratio and redraw strategy

Deep drawing is generally considered “deep” when depth exceeds the part’s diameter, and deeper draws often require redraw steps rather than forcing a single hit. Wikipedia Every redraw step can mean additional stations, tooling complexity, and more opportunities for tolerance stack-up, which increases both NRE and cycle time.

If your part is near the forming limit, you may need process aids (intermediate anneal, special lubrication, draw beads, or controlled blank holder force). Those are not “nice-to-haves.” They are direct cost drivers.

Corner radii, die entry radii, and fracture risk

Tight radii look compact in CAD, but they can drive higher forming stress and increase thinning/tearing risk. The total drawing load includes the ideal forming load plus friction and bending/unbending components at the die radius, so geometry and friction interact strongly. Wikipedia When cracking risk rises, costs appear as slower line speeds, more rejects, extra polish/tryout loops, or a redesign.

Holes, slots, and features in the drawn wall

Adding pierced features in the sidewall is possible, but it often shifts the process from “simple draw + trim” to a more complex progression with piloting, restrike, or secondary machining. That complexity can be justified, but it should be treated as an upfront decision: do you want lower unit labor via integrated tooling, or lower NRE via secondary operations?

Tolerance strategy: don’t over-spec what you don’t need

Overly tight tolerances can force additional sizing/restrike stations, more frequent tool maintenance, and heavier inspection sampling. In deep drawn metal stamping, the process naturally produces some thickness variation and dimensional springback, so tolerances should match function rather than defaulting to “as tight as possible.” Wikipedia

A practical rule is to define critical-to-function dimensions and allow the rest to follow standard stamping capability. This reduces both inspection cost and process friction.

Material selection: cost is not just $/kg

Material is frequently the largest line item, but OEM programs often underestimate how material selection drives yield, press force, die wear, and scrap risk.

Formability and required draw force

Softer materials generally require less force to draw, while higher-strength materials require higher tonnage and may need more conservative draw conditions. Wikipedia Press tonnage choice matters because it affects which press line you can run on, achievable speed, and whether you need specialized equipment.

Material choice also impacts wall thinning behavior and the risk of splits, which can drive hidden cost through scrap and sorting.

Thickness and coil/blank quality

A small thickness change can shift draw success windows, especially when the part is near forming limits. Coil flatness, surface condition, and lubrication compatibility matter too, because friction variability can show up as wrinkles, tearing, or unstable dimensions.

In OEM programs, you pay twice for unstable incoming material: once in scrap, and again in troubleshooting time.

Plated and coated materials vs post-process finishing

Pre-plated materials can reduce finishing steps, but they may create forming challenges (surface galling, coating damage, or higher friction). Post-process plating or passivation adds lead time, outside supplier risk, and cost per piece, but can be better for cosmetic control.

The best answer depends on volume, cosmetics, corrosion requirements, and how your OEM handles supplier quality audits.

Tooling and die design: the NRE that controls your piece price

Tooling is where deep drawn metal stamping programs “win” or “bleed.” Well-designed tooling reduces scrap, stabilizes dimensions, and keeps maintenance predictable.

Single die, transfer die, progressive die, and press-line choices

Choosing the forming strategy changes both capital and operating cost. Progressive dies integrate multiple operations across stations as the strip advances, which can reduce per-piece handling and improve throughput in high volume. Hudson Technologies Transfer systems and press lines can be effective for larger drawn parts or when strip progression is impractical.

From a cost-driver standpoint, the key is not which method is “best,” but which method minimizes total cost at your expected annual volume while meeting your quality targets.

Blank holder force control and wrinkling prevention

Wrinkling is a classic deep drawing defect driven by compressive hoop stresses in the flange, and blank holders are commonly used to control the metal flow and prevent wrinkles. Wikipedia However, blank holder force is not “more is better.” If set too high, it can increase stretching and thinning and raise the chance of splits. Metal Forming Magazine

Cost appears here in two ways: repeated tryout loops during launch, and ongoing scrap if the forming window is too narrow.

Tool steel selection, coatings, and wear management

Punch and die materials (tool steels, heat treatment strategy, and coatings) directly affect die life and maintenance intervals. Wikipedia In an OEM program, predictable maintenance is often more valuable than theoretical maximum speed, because unplanned downtime triggers expedited freight, missed builds, and line disruptions.

If your program has high abrasiveness or difficult lubrication conditions, tool coatings and surface finish planning can pay back quickly.

Gauging and inspection fixtures as “tooling”

Fixtures and gauges are part of tooling cost, not a separate afterthought. If your OEM requires capability studies or structured submissions, you may need dedicated gauges that mirror datum strategy and allow repeatable measurement.

Good gauging reduces disputes and accelerates approval. Poor gauging creates arguments, delays, and costly re-measurement cycles.

Press time and line efficiency: where pennies become dollars

After material, press time is usually the most visible recurring cost. But the real driver is not just “seconds per part.” It’s effective equipment utilization under stable quality.

Tonnage, stroke, and speed limits

Press selection depends on material, draw depth, and the friction/thinning conditions you are running. Deep drawing load is influenced by friction and bending/unbending at the die radius, so lubrication and geometry can change the tonnage needed. Wikipedia If you require higher tonnage, you may be forced onto a different press class with a different hourly rate.

Also, “faster” can be more expensive if it increases scrap or accelerates die wear.

Setup time and changeover strategy

OEM programs often involve family parts, revisions, and schedule swings. If your tooling and process plan reduce setup time (standardized clamps, quick-change pilots, documented setup sheets), you reduce the “hidden overhead” baked into piece price.

For medium volumes, setup cost can outweigh cycle-time savings, so designing for fast setup is a legitimate cost strategy.

Scrap rate as the silent killer

A 2% scrap rate can look small, but in high-volume production it’s real money: wasted material, wasted press time, and often extra labor for sorting. Scrap also triggers downstream costs—especially if parts are plated, cleaned, or heat-treated before defects are detected.

Your cheapest path is always: detect defects as early as possible and design the process to avoid generating them in the first place.

Secondary operations and finishing: where OEM requirements add layers

Many deep drawn components are not finished “out of the die.” Secondary operations often become the difference between a low-cost concept and a high-cost reality.

Trimming, piercing, and edge conditioning

Trim operations can be integrated into tooling or done as a secondary step. Integrated trimming saves handling but may require additional stations and sharpening maintenance. Secondary trimming can increase labor and WIP but may be more flexible during early revisions.

Edge deburring and conditioning can also be a significant cost driver if your OEM has safety or assembly requirements, especially for battery enclosures, sensor housings, or medical subassemblies.

Cleaning, degreasing, and contamination control

Lubrication is essential for stable deep drawing, but it creates cleaning requirements downstream. If your part goes into electronics, sensors, or sealing applications, cleanliness requirements can drive both process and packaging cost.

This cost is often underestimated at quoting stage, so it should be made explicit: cleanliness spec, test method, and acceptance criteria.

Heat treatment, annealing, and dimensional stability

Depending on material and draw severity, intermediate annealing may be required to recover ductility for further forming. Each thermal step adds cost and lead time, and it also introduces dimensional variation risk that may require a sizing operation.

The right answer is not “avoid heat.” It’s to decide early whether heat treatment is part of the manufacturing strategy, and then design tooling around it.

Plating, passivation, and corrosion protection

Corrosion requirements can force plating, passivation, or special coatings. If you outsource finishing, supplier selection and logistics become cost drivers, and you need clear quality agreements to avoid rework cycles.

For OEM programs, finishing also changes your measurement strategy, because coating thickness and surface condition affect both dimensions and functional fit.

Quality, documentation, and OEM approvals: the cost you don’t see on the press

OEM programs price risk. Quality requirements convert risk into documented evidence, and that evidence costs time and resources.

PPAP, sample approval, and “launch costs”

Many OEM supply chains use PPAP (Production Part Approval Process) to confirm that engineering requirements and manufacturing processes can consistently produce conforming parts at production rates. AIAG PPAP-related work often includes documentation, sample builds, dimensional reports, and process evidence that must be prepared and reviewed.

Even if your industry doesn’t call it PPAP, the pattern is the same: approval packages, sign-offs, and controlled launch gates.

IATF 16949 mindset and process control expectations

IATF 16949 defines quality management requirements across the automotive industry and emphasizes robust systems that reduce variation and prevent defects. IATF Global Oversight The program cost impact is real: control plans, traceability expectations, corrective action systems, and measurement discipline.

If your supplier isn’t prepared, you’ll pay in delays, containment actions, and repeated audits. If your supplier is prepared, you usually pay less over the life of the program.

Inspection planning: CMM, vision, go/no-go, and sampling rates

Inspection cost is driven by method and frequency. Tight tolerances, complex geometry, and cosmetic requirements can push you toward more expensive measurement methods and higher sampling rates.

A smart strategy is to use process control to reduce inspection frequency, but that requires a stable and documented process window.

Supply chain and logistics: cost drivers outside the die

OEM programs rarely live in one factory. Materials, finishing, and delivery often span multiple sites or partners, and logistics can become a major lever.

Lead time, buffer stock, and expedited freight

When deep drawn metal stamping programs ramp, schedule volatility is normal. If the supply chain is not resilient, expedited freight becomes a recurring “tax” on the program, especially for international shipments.

Building a realistic buffer strategy is often cheaper than repeatedly expediting parts during demand spikes.

Packaging, part protection, and cosmetic rejects

Deep drawn parts often have cosmetic surfaces or sealing features. If packaging is not designed to protect edges and surfaces, you’ll see damage, returns, and sorting cost at the OEM side.

This is a cost driver that is easy to fix early and expensive to fix late, because you’ll be debugging it during production pressure.

Program volume and lifecycle: how to choose the right cost model

A quote that looks great at 10,000 parts/year may be expensive at 1,000,000 parts/year, and vice versa. OEM programs need a cost model that matches lifecycle reality.

Prototype vs pre-production vs mass production

Prototype methods prioritize speed and flexibility, so they often use simpler tooling and more manual steps. Pre-production introduces more control and proof, while mass production needs automation, die life, and stable cycle times.

Treating a prototype process as a production process is one of the fastest ways to inflate cost later. Treating a production process as a prototype process is one of the fastest ways to inflate NRE now.

Engineering change management

Revisions are a normal part of OEM work. The cost driver is not the change itself, but how the tool is designed to accommodate changes.

DFM collaboration early—before tool steel is cut—often creates the biggest savings on the entire program.

Practical cost-reduction strategies that protect quality

Cost reduction should not mean “cheapening the part.” In deep drawn metal stamping, the best savings come from eliminating instability and waste.

Use DFM to simplify without losing function

Ask design questions early: Can radii be opened slightly? Can a slot move to a less sensitive location? Can tolerances be aligned with natural forming capability? Each small decision can eliminate a station, a secondary step, or a high scrap risk.

Two hours of DFM now can save weeks of tool rework later.

Design the process window, not just the geometry

Stable deep drawing relies on controlled material flow via blank holder strategy, die radii, lubrication, and appropriate force levels. The Library of Manufacturing If your process window is wide, your cost stays stable through shifts, coil lots, and normal production variation.

If your process window is narrow, your “cheap” part becomes expensive through scrap, downtime, and containment actions.

Optimize for total landed cost

For OEM programs, total cost includes: yield, inspection, packaging, logistics, and approval effort. A slightly higher piece price that includes stable packaging, clear documentation, and controlled quality often wins when you measure total landed cost over the program.

How JUMAI TECH supports OEM cost targets in deep drawn metal stamping

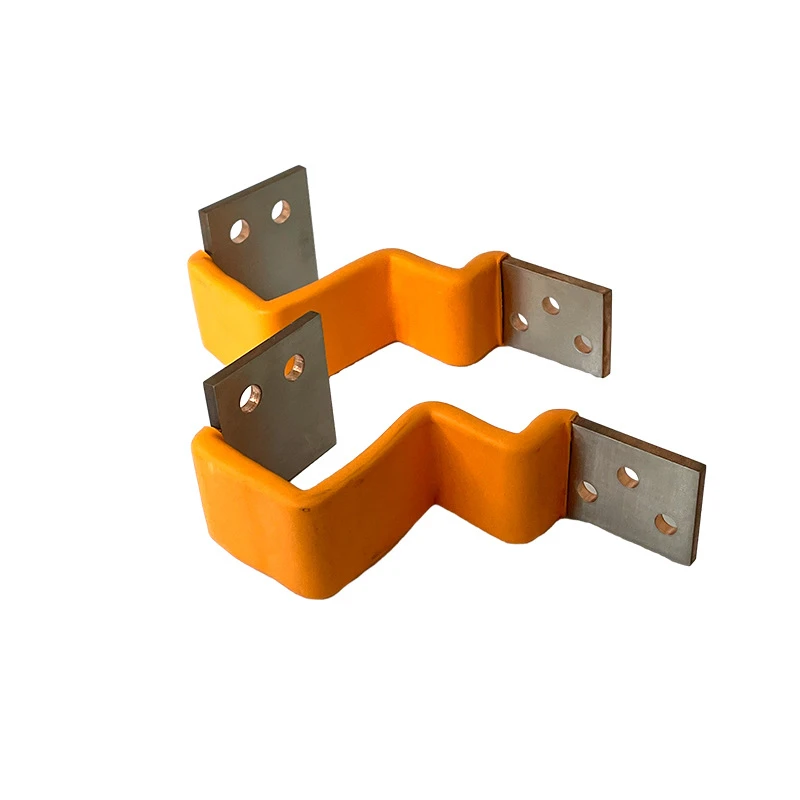

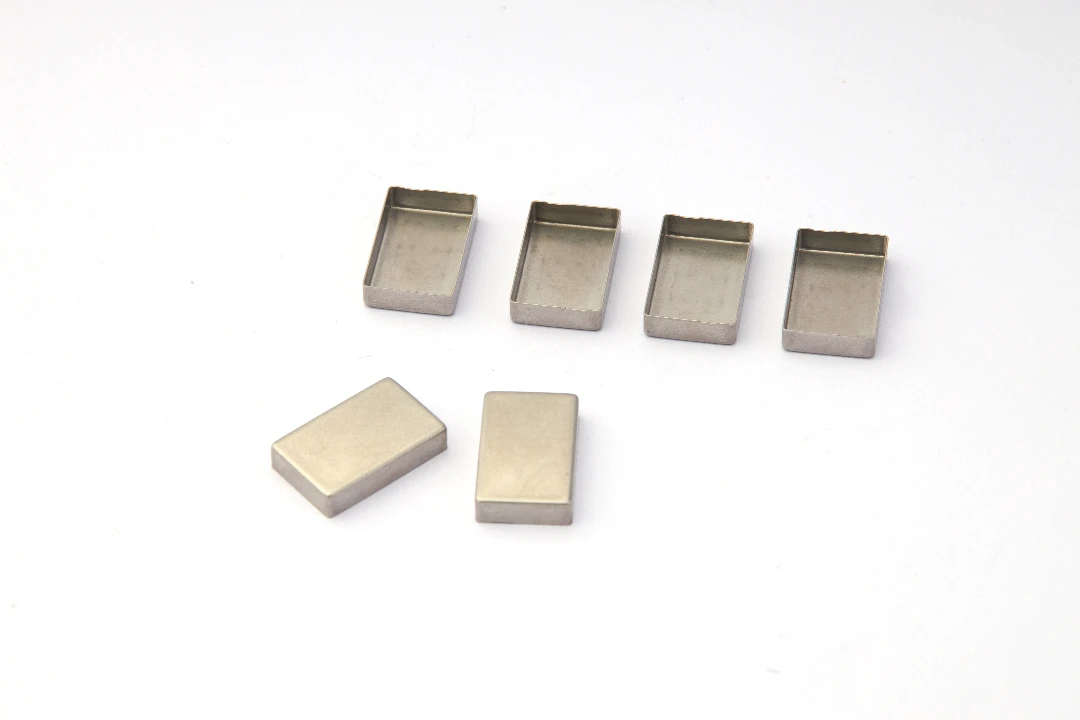

At JUMAI TECH, we approach deep drawn metal stamping the way OEM programs demand: design collaboration, disciplined tooling strategy, and production-ready control. We support custom deep drawn components alongside precision stamping dies and related metal forming capabilities, so the same team can align part geometry, die design, and manufacturability from the first RFQ.

Early collaboration to prevent cost surprises

We focus on DFM alignment before tooling release: draw depth strategy, radii, tolerance targeting, and feature sequencing. This reduces redraw loops and avoids late-stage process patches that inflate cost.

Tooling built for stability and maintainability

OEM programs need predictable output. We emphasize die concepts that protect the forming window, manage friction and wear, and allow maintenance without breaking dimensional control.

Documentation and approval readiness

Whether your program requires PPAP-style evidence or a custom OEM submission package, we plan validation builds, measurement strategy, and process control evidence early so approvals don’t become schedule surprises. AIAG

Cost control starts before the press starts

The true cost drivers in deep drawn metal stamping are set early: geometry decisions, material choice, process strategy, and tooling architecture. Press time matters, but it’s usually the last lever—not the first.

If you want a deep drawn metal stamping supplier who can help you hit OEM cost targets without sacrificing quality, the best next step is a technical RFQ discussion. Share your drawing, target volume, key functional dimensions, and any approval requirements, and we’ll help you build a cost model that stays stable from prototype to production.